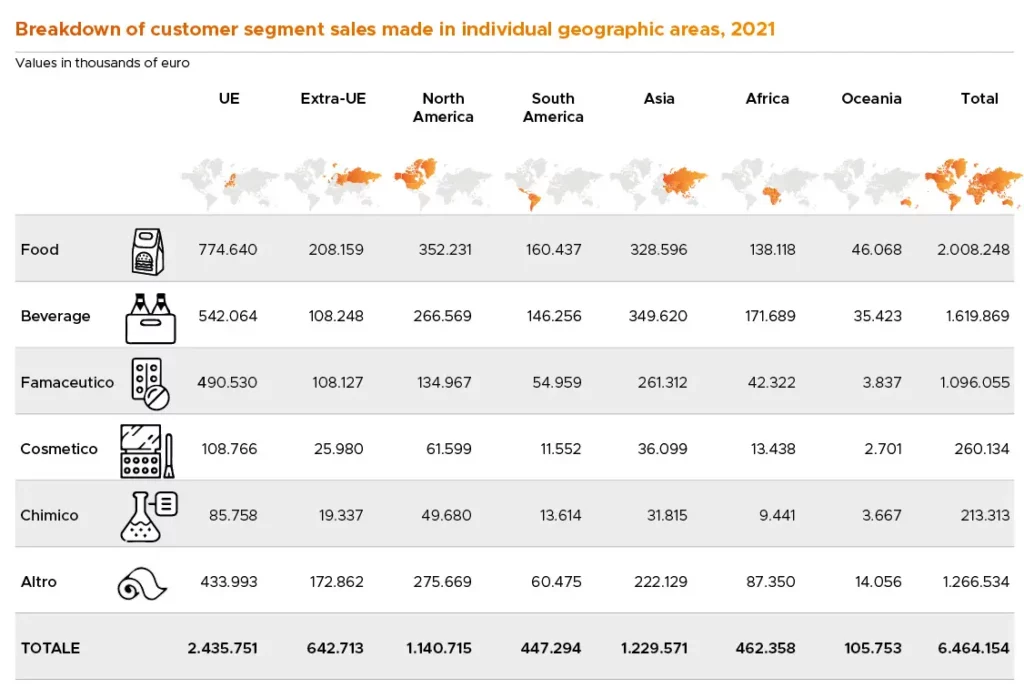

The Italian manufacturers of packaging technology and solutions maintained their strong export propensity in 2021 with foreign sales of €6.46 billion, 78.4% of the total. Following the 4% decline in 2020, exports resumed growth at +6.2%.

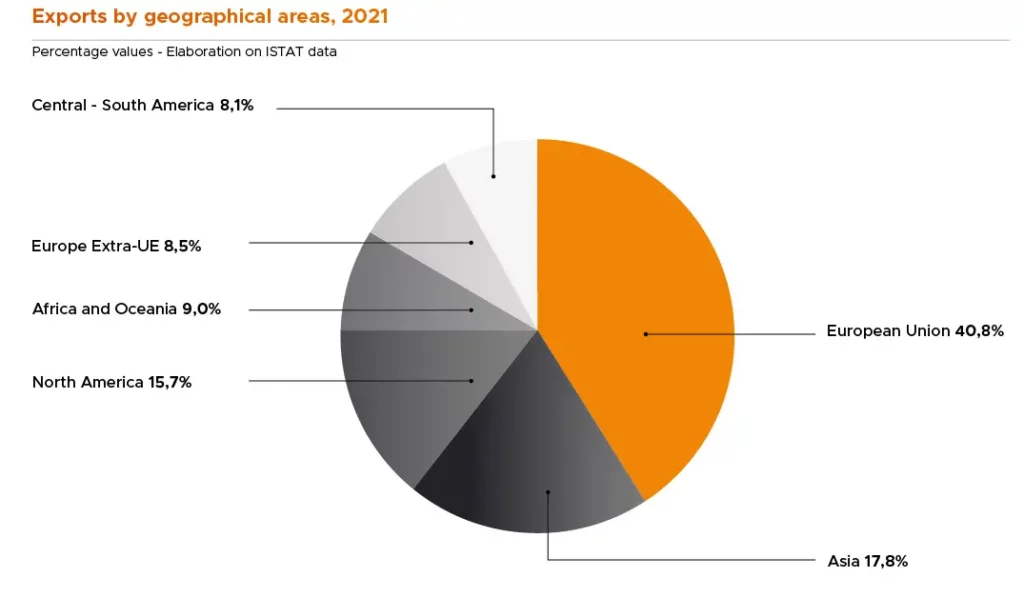

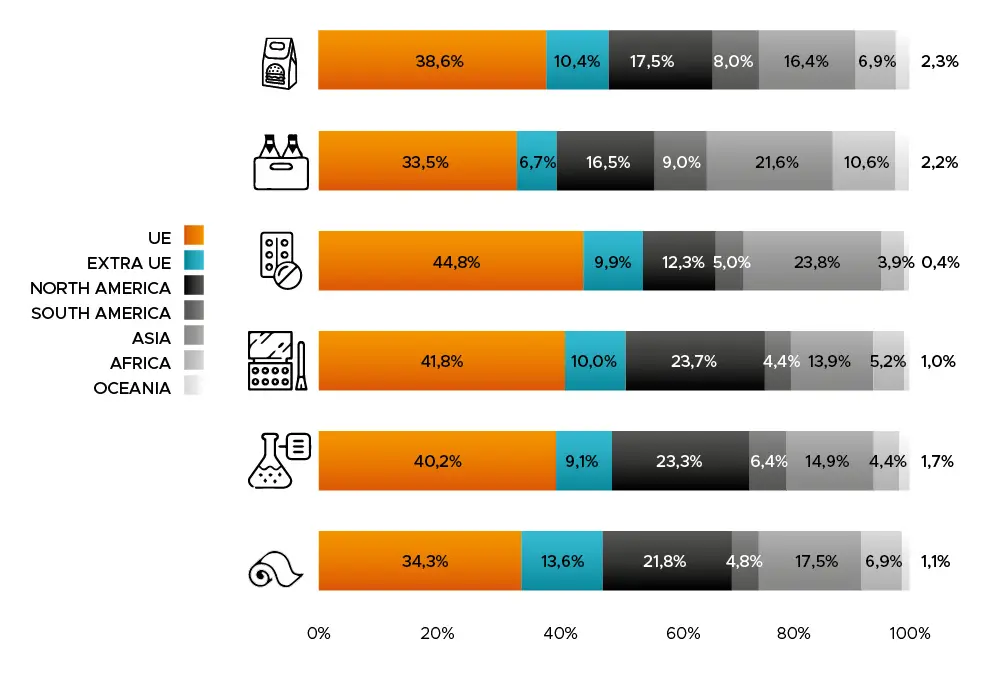

The European Union maintained its position as the largest market for Italian machinery with revenues of €2.15 billion, up 3.4% compared to 2020 and equivalent to 40.8% of total exports. Asia lost ground (-4.4%) but remained the second most important export market for Italian packaging technology with sales of €942 million, 17.8% of the sector’s total exports.

In third place was North America with an impressive 13% year-on-year growth to €828 million following the 6% increase reported in 2020. Africa and Oceania followed in fourth place with 9% of the total export turnover (€473 million), overtaking non-EU Europe, while Central and South America closed the ranking in sixth place.

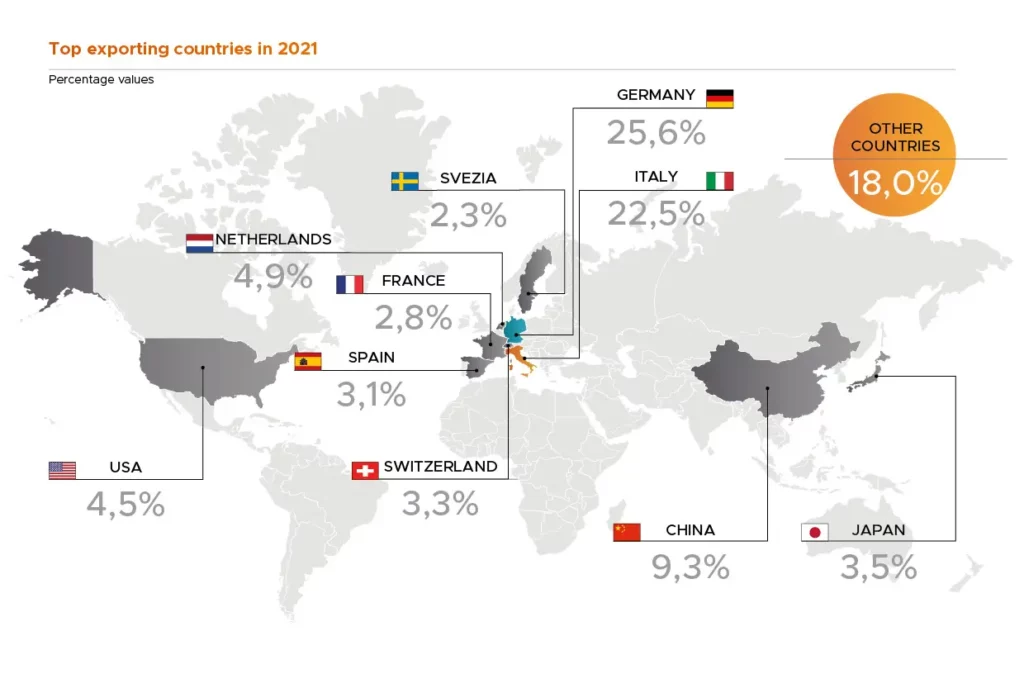

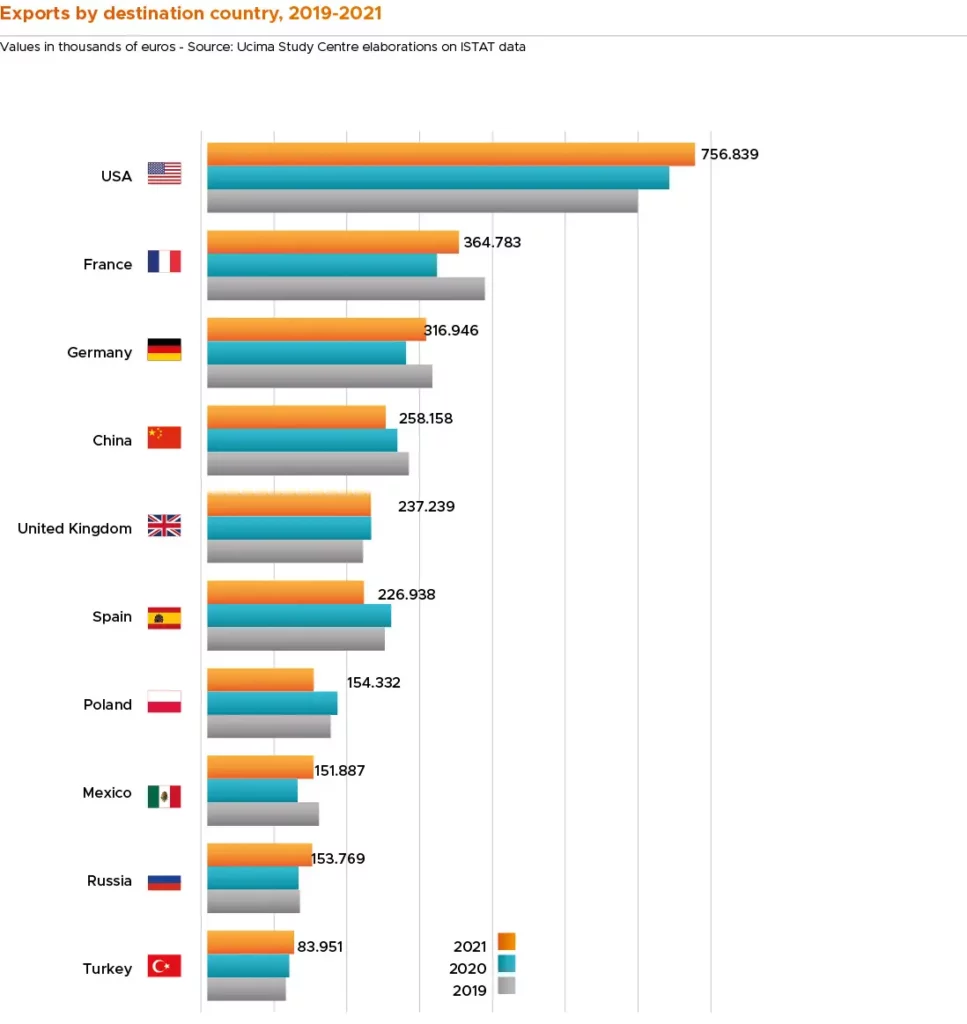

The USA topped the ranking of individual countries with €756 million of machinery sales. This marked 13.1% growth compared to 2020 following the previous years’ increases. Next came France and Germany, which after the falls of 2020 resumed growth (+9.6% and +10.1% respectively). Exports to France totalled €364 million, while German companies purchased €316 million worth of Italian machinery. China remained in fourth place ahead of the UK, which overtook Spain in 2021.

Opening image by tawatchai07 on Freepik